Making sense of the Spread

When you buy, sell, or swap crypto through Pay It Now, you’ll notice that we don’t charge traditional trading or forex fees.

Instead, a small spread applies, and that’s the only cost you’ll ever pay when converting assets on our Network.

Making sense of the Spread

When you buy, sell, or swap crypto through Pay It Now, you’ll notice that we don’t charge traditional trading or forex fees.

Instead, a small spread applies and that’s the only cost you’ll ever pay when converting assets on our Network.

What Is a Spread?

A spread is the small difference between the buy price and sell price of an asset.

It’s how Pay It Now, like most financial platforms cover the cost of facilitating transactions on our network. Unlike many exchanges that layer on multiple fees (trading/service and/or forex), Pay It Now only includes a single small spread, built directly into the price you see in-app.

No add-ons. No surprises.

The spread is applied whenever an exchange between assets occurs, such as:

Buying crypto (e.g., converting NZD or AUD into BTC or USDC)

Selling crypto (e.g., converting BTC back to NZD or AUD to withdraw to your bank account)

Swapping crypto to crypto (e.g., BTC → USDC)

Spending (At a merchant or within our SHOP menu e.g Buying a Giftcard or Pre-paid Debit card)

Topping up your Web3 Mastercard (crypto converted to USDC)

Essentially, any time a conversion happens from traditional currency to crypto or between digital assets on our network, the spread applies. See our fees page full details

How We Calculate the Spread

Our pricing is determined by live market data. Pay It Now sources real-time rates from leading market determiners and continuously monitors several of the world’s major exchanges.

This ensures our buy and sell prices remain competitive

Because we operate on our own Layer-2 network, our spreads remain small as we don’t rely on external intermediaries or inflated mark-ups.

When the Spread Applies

What Is a Spread?

A spread is the small difference between the buy price and sell price of an asset.

It’s how Pay It Now, like most financial platforms, covers the cost of facilitating transactions on our network. Unlike many exchanges that layer on multiple fees (trading/service and/or forex), Pay It Now only includes a single small spread, built directly into the price you see in-app.

No add-ons. No surprises.

How We Calculate the Spread

Our pricing is determined by live market data. Pay It Now sources real-time rates from leading market determiners and continuously monitors several of the world’s major exchanges.

This ensures our buy and sell prices remain competitive

Because we operate on our own Layer-2 network, our spreads remain small as we don’t rely on external intermediaries or inflated mark-ups.

When the Spread Applies

The spread is applied whenever an exchange between assets occurs, such as:

Buying crypto (e.g., converting NZD or AUD into BTC or USDC)

Selling crypto (e.g., converting BTC back to NZD or AUD to withdraw to your bank account)

Swapping crypto to crypto (e.g., BTC → USDC)

Spending (At a merchant or within our SHOP menu e.g Buying a Giftcard or Pre-paid Debit card)

Topping up your Web3 Mastercard (crypto converted to USDC)

Essentially, any time a conversion happens from traditional currency to crypto or between digital assets on our network, the spread applies. Check out our fees page full details

One Simple Cost. Easy to Understand.

Think of it like this: when booking a flight, rental car, or concert ticket, most service providers add-on unavoidable extra fees at the checkout.

At Pay It Now, our spread is upfront and all-inclusive. You shouldn’t need a calculator or a math degree to work out what you’re paying. That’s not how simple should feel.

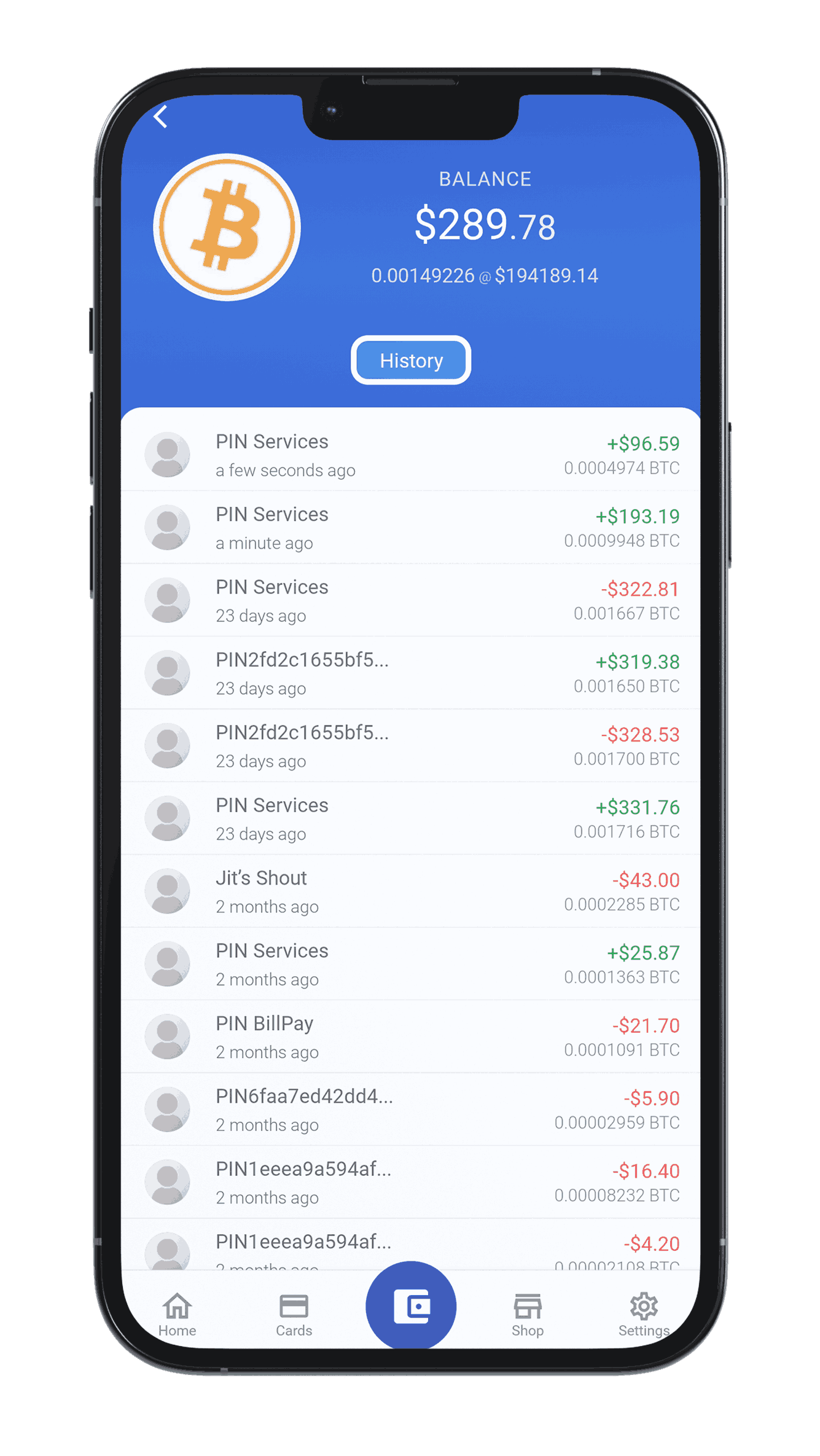

Example: A Typical Trade on the PIN Network

Scenario 1 — Buy Crypto

Top-up method: Manual bank deposit (NZD)

Action: Buy BTC

Fee: Only the spread

NO FEE

NZD Bank Transfer

PAY ONLY THE SPREAD

Buy BTC

Deposited to your

PIN Account

You deposit $100 NZD into your Pay It Now account and buy Bitcoin.

You’ll pay a small spread to convert your NZD into BTC. For example, you might receive $98 NZD worth of BTC in your app wallet.

Your total cost of conversion = $2 spread.

(This is only an example. Actual spreads vary depending on market rates, liquidity, and network activity.)

Example: A Typical Trade on the PIN Network

Scenario 1 — Buy Crypto

Top-up method: Manual bank deposit (NZD)

Action: Buy BTC

Fee: Only the spread

NO FEE

NZD Bank Transfer

PAY ONLY THE SPREAD

Buy BTC

Deposited to your

PIN Account

You deposit $100 NZD into your Pay It Now account and buy Bitcoin.

You’ll pay a small spread to convert your NZD into BTC. For example, you might receive $98 NZD worth of BTC in your app wallet.

Your total cost of conversion = $2 spread.

(This is only an example. Actual spreads vary depending on market rates, liquidity, and network activity.)

Scenario 2 — Buy + Unbridge to External Wallet

Top-up method: Manual bank deposit (NZD)

Action: Buy BTC and unbridge to your own wallet

Fees: Spread + Unbridge Fee + External Network Fee

NO FEE

NZD Bank Transfer

PAY ONLY THE SPREAD

Buy BTC

Unbridge Fee

Withdraw to external wallet

Network Fee

Charged by external network

You buy $100 NZD worth of BTC. You’ll pay the $2 spread, then a small unbridge fee (for transferring assets off-network), and finally the Layer-1 blockchain gas fee which goes to the external network, not Pay It Now.

Example breakdown:

$100 → ($2 spread) = $98 → ($0.98 unbridge fee) = $97.02 BTC → (Network Fee)

External network fee (varies depending on congestion and gas prices).

Scenario 2 — Buy + Unbridge to External Wallet

Top-up method: Manual bank deposit (NZD)

Action: Buy BTC and unbridge to your own wallet

Fees: Spread + Unbridge Fee + External Network Fee

NO FEE

NZD Bank Transfer

PAY ONLY THE SPREAD

Buy BTC

Unbridge Fee

Withdraw to external wallet

Network Fee

Charged by external network

You buy $100 NZD worth of BTC. You’ll pay the $2 spread, then a small unbridge fee (for transferring assets off-network), and finally the Layer-1 blockchain gas fee which goes to the external network, not Pay It Now.

Example breakdown:

$100 → ($2 spread) = $98 → ($0.98 unbridge fee) = $97.02 BTC → (Network Fee)

External network fee (varies depending on congestion and gas prices).

The Layer-2 Advantage

In Summary:

• Pay It Now applies only one small spread to asset conversions.

• No trading, forex, or service fees are added on top.

•The spread keeps pricing simple and easy to manage

• Any additional costs (e.g., blockchain gas fees) are charged by external networks - not by Pay It Now.

Fair pricing is part of our design.

That’s why we keep our pricing fair and simple to understand, so Kiwis and Aussies can enjoy crypto the way it should be: affordable and straightforward

View all current rates and fees

Disclaimer: This information is for general guidance only and not financial advice. Spreads and rates may change at any time based on market conditions and liquidity. External network fees are set by third parties and are outside of Pay It Now’s control. Examples are illustrative only and may not reflect your actual trade.